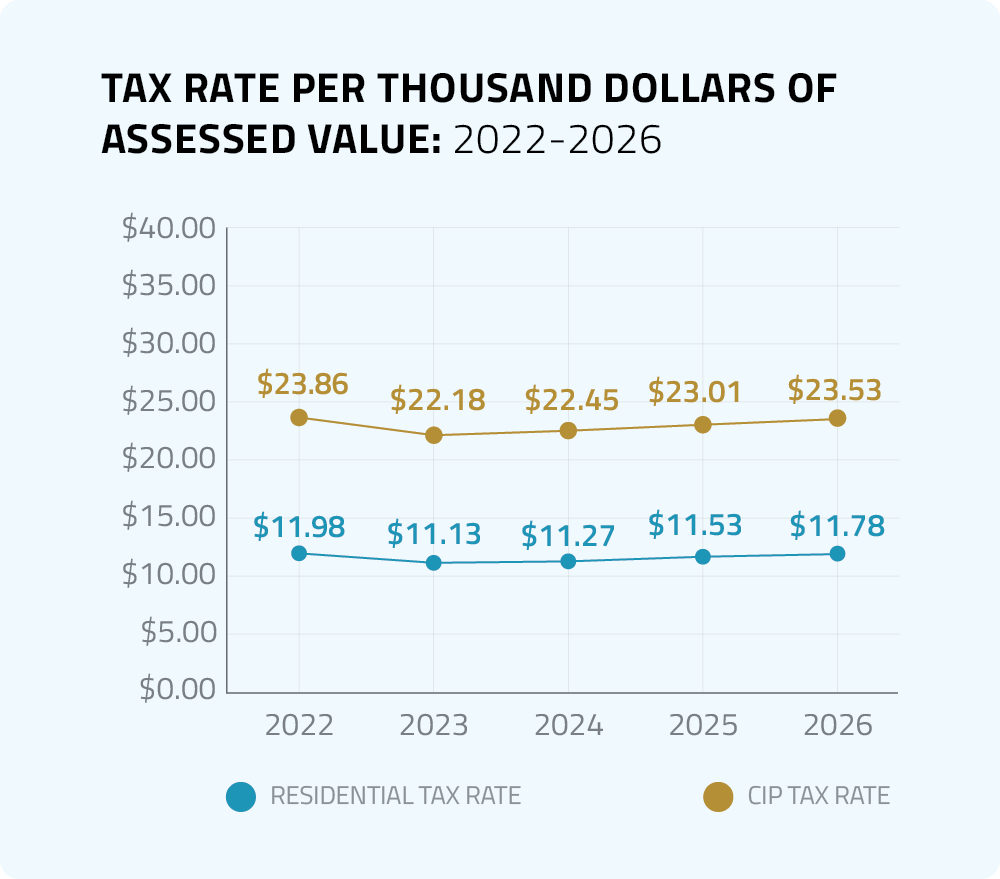

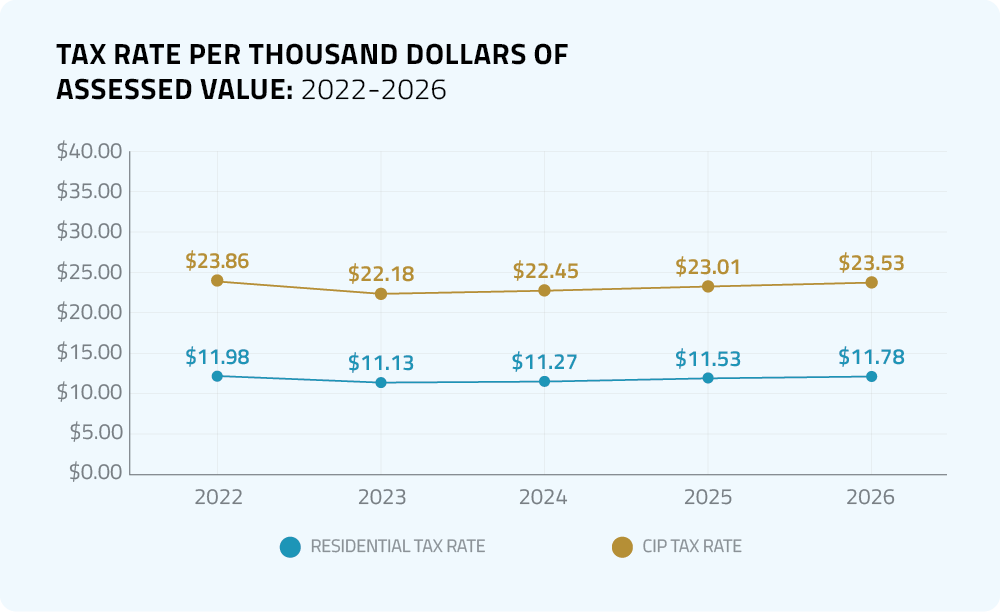

Tax Rates

| Fiscal Year | Residential Tax Rate | Commercial Tax Rate |

| 2026 | $11.78/ $1,000 of assessed value | $23.53 / $1,000 of assessed value |

| 2025 | $11.53/ $1,000 of assessed value | $23.01 / $1,000 of assessed value |

| 2024 | $11.27 / $1,000 of assessed value | $22.45 / $1,000 of assessed value |

Calculating Property Taxes

Once the City has determined the tax rate for each property class, individual properties will have their taxes calculated using a specific equation.

These taxes are then displayed on the tax bill of each property owner.

These taxes are then displayed on the tax bill of each property owner.

To learn more about how the tax rate is calculated, go to the Understanding Your Taxes Brochure on page 9.

Key Assessing Information

Tax Rate per thousand dollars of assessed value: 2022-2026

Key Assessing Information

Tax Rate per thousand dollars of assessed value: 2021-2026